News

The Evolution of POS Systems

Good To Know

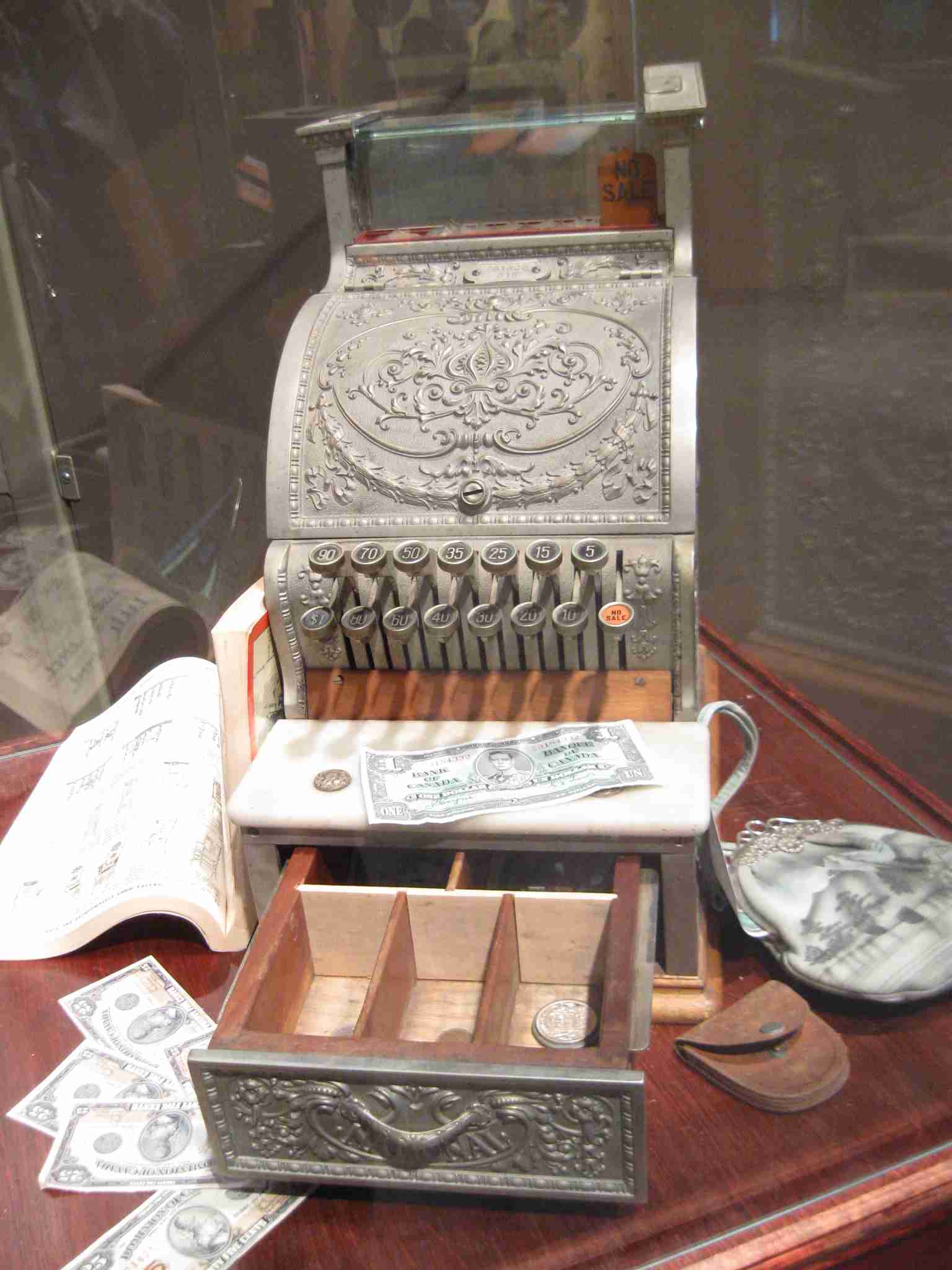

A cash register, also known as a till or automated money management system, is a mechanical or electronic device designed to record and process transactions at the point of sale. Typically, it includes a secure drawer for storing cash and other important items. In modern setups, cash registers are often connected to a printer, enabling the production of receipts for customer records and business documentation.

The Evolution Of POS System

Following the American Civil War, James Ritty and John Birch invented one of the earliest mechanical cash registers. James, who owned a saloon in Dayton, Ohio, sought a solution to prevent employees from skimming profits. Inspired by a device he saw on a steamship that counted propeller revolutions, James, with the assistance of his brother John, developed the Ritty Model I in 1879. They patented their invention in 1883, calling it "Ritty's Incorruptible Cashier." This device was specifically designed to deter employee theft and embezzlement.

The first mechanical cash registers were purely mechanical, with no option for printing receipts. Each time a transaction was completed, the cashier would ring it up, and when the total key was pressed, the cash drawer would open with a ringing bell to alert the manager that a sale was being processed. These early machines functioned primarily as simple adding devices.

The practice of odd pricing, such as charging 49 or 99 cents, is believed to have emerged to ensure that cashiers opened the till to provide change, thus recording the transaction and announcing the sale, as noted by author Bill Bryson. This method helped reduce the likelihood of theft.

Overwhelmed by the demands of managing two businesses, James Ritty sold his cash register business to Jacob H. Eckert of Cincinnati, a china and glassware merchant, who founded the National Manufacturing Company in 1884. Later, John H. Patterson acquired the company, renaming it the National Cash Register Company. Patterson made significant improvements, including adding a paper roll to record sales, creating an internal journal for bookkeeping and providing receipts for customers. This addition enhanced fraud protection by allowing business owners to verify that transactions were correctly recorded and cashiers were not misappropriating funds. Receipts also served to prevent customers from making false claims about incorrect change or nonexistent transactions.

In 1906, Charles F. Kettering, working for the National Cash Register Company, designed a cash register equipped with an electric motor, further advancing the technology.

From the 1950s to the 1970s, Gross Cash Registers Ltd., founded by brothers Sam and Henry Gross in London, became a leading manufacturer and exporter of cash registers. Their products gained particular popularity during the decimalization in Britain in 1971. Henry Gross designed a unique model of cash register that could switch between the old £sd currency and the new £p system, making the transition easier for retailers. Sweda also produced registers that could be converted to the new decimal system with a special key, ensuring a smooth transition on Decimal Day.

A Journey Through Time

Modern cash registers are often integrated with various peripherals such as scales, barcode scanners, checkstands, and payment terminals for debit and credit cards. However, the trend is moving towards replacing dedicated cash registers with general-purpose computers running Point of Sale (POS) software.

Today’s POS systems offer a wide range of functionalities. They scan barcodes—typically EAN or UPC—to retrieve item prices from a database, apply discounts for promotional items, calculate sales tax or VAT, and adjust prices for preferred customers. These systems also update inventory in real time, timestamp transactions, and record detailed sales information, including the items purchased and the method of payment. Additionally, they track sales by product type and period, and often include the cashier’s details on the receipt along with promotional messages or offers.

Nowadays, many cash registers are standalone computers that may run either custom in-house software or general-purpose operating systems like DOS. Many newer models feature touchscreens and can be connected to computerized POS networks using various protocols. These systems are often accessible remotely for record retrieval or troubleshooting purposes. Increasingly, businesses are adopting tablet computers as cash registers, using POS software apps that offer the same robust functionality as traditional systems.

Conclusion

Cash registers have come a long way from their humble mechanical beginnings to the sophisticated, multifunctional systems we see today. Once simple devices designed to prevent theft and ensure accurate sales recording, they have evolved into powerful tools that integrate inventory management, customer relationship features, and real-time data processing. As technology continues to advance, the trend towards using general-purpose computers and tablets equipped with POS software is likely to grow, offering businesses even more flexibility and efficiency. The future of cash registers lies in their continued adaptation to meet the demands of modern commerce, ensuring accuracy, security, and seamless customer experiences in an increasingly digital world.